Glossary - J to R

First.....Prev.....Next.....Last

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

Speed Keys >> Top = Ctl+Home, End = Ctl+End, Page Up, Page Down

J

K

L

Landlord Code

Each landlord has a unique four digit system assigned code allocated when the landlord is created. There is no relationship between the landlord code and the property code or the tenant code. Do not try and use the same code for the landlord and property and tenant, unless you have a really compelling reason. Attempting to apply the same code to the landlord, property and tenant falls apart the moment the landlord has multiple properties and when the original tenant vacates and a new one moves in. You can not have multiple landlords, properties or tenants with the same code.

When creating a new landlord you may override the system assigned code before saving the details. Alternatively use the Landlords menu > Renumber Landlord function.

Ledger

See first few paragraphs of the Accounting Primer

Letting Fee

The amount charged by you to the tenant, for placing them in the landlord's property. Historically this is one week's rent plus GST but could be any value at all. The amount of the letting fee charged is entered when creating a new tenant and must be the GST inclusive amount. See Letting Fee main topic

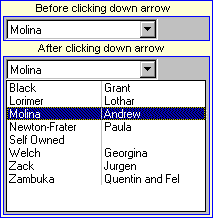

List box

A list box is a device used to select one item from a list. The selected item is displayed in a box with a down arrowhead at one end. Clicking the arrow (actually anywhere in the box) displays a list from which a choice can be made.

Type the first few letters of the required item in the box to locate the item quickly.

When all items in the list do not fit in the list box a scroll bar is provided.

Top

M

Mail merge and Exporting data

Information in the database may be merged with standard letters. It may also be exported to other programs such as word processing where the limited facility internal mail merge fails to meet your needs.

See Mail Merge and Export

Management fee

Management fees are charges deducted from the rent paid by the tenant with the balance going to the landlord. The rate charged is set in the fees schedule and may be either a percentage of the transaction amount or a flat fee of "X" dollars and cents. The actual fee charged against any rent paid is charged according to the fee structure assigned to the property not the landlord.

Management fees can not be overridden during transaction entry and exclude GST.

See Discussion section of the Fees Schedule topic and compare to - Disbursement fees.

Maximise and Minimise

See Screen Sizing

Memo field

See Text and Memo Fields

Merge Code

A merge code is a "placeholder" within a document where data associated with the recipient is extracted from the database and inserted. They are delimited by { } braces (curly brackets) which are reserved characters and must not be used in any standard letter. Merge codes are used in letters, faxes, emails and SMS messages being sent from the Aspect Property Manager to landlords, tenants and suppliers. Most often the document will be a standard letter where the general text remains the same but the data is dependent upon the person receiving the letter. They may be used in the production of a letter to a single recipient or in a mail merge where a single letter it sent to many different recipients.

See XXXX several

Menu

The Menu Bar is the Windows term for the line below the Title bar at the top of the screen.

It usually contains a number of menus each one having a selection of choices which appear when the menu name is clicked.

Menus are also often displayed by right-mouse clicking objects which will display a "pop-up menu" of choices.

Most menu choices have an underlined character which can be used as a speed key. Depressing the Alt key and the speed key at the same time will perform the same action as clicking the item with the left mouse button. Speed keys are often much quicker than using the mouse.

Monthly Rent Calculation

If a tenant wishes to pay monthly and you have the rent expressed as dollars per week use the Popup Calculator Utilities to work this out for you. The monthly rate is charged regardless of the number of days in the month (swings and roundabouts) and you will lose one day's rent each leap year.

There will inevitably be occasional rounding errors and you will need to make an executive decision that $99.99 per week should actually be $100 per week.

When your calculator gives a slightly different figure to the Aspect Property Manager calculation it may simply be the calculator rounds, or doesn't round, or you have pushed "=" between steps.

The formula used to convert a daily, weekly or fortnightly rent to a monthly rent is to convert the rent to a daily rate, multiply that by 365 and divide the answer by 12. For example $70 per week = $10 per day times 365 = $3650 divided by 12 = $304.17 per month.

When converting a monthly rate to a daily, weekly or fortnightly figure multiply the monthly rate by 12, divide that by 365, then multiply the result by 7 or 14 (days) accordingly. For example $435 per month time 12 = $5220 divided by 365 times 7 = $100.11 per week.

Move In Cost

The Move in cost is the amount the tenant is required to pay take up the tenancy. It is a programmed calculation based on the Desired Rent and uses the entries made on the Setup menu > Company Details > Move In Costs tab. The calculated values may be overkeyed if required. Once changed the system remembers the entries until any of the component values are changed.

When the property has a monthly rent period the move in cost calculation establishes a weekly rental amount to use when working out the intial rent, letting fees, and bond required with the following calculation:-

weekly rent amount = (( monthly rent * 12 ) / 365 ) * 7 ) rounded to the nearest cent.

Top

N

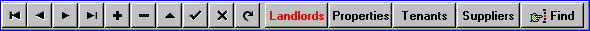

Navigator Bar

A Navigator Bar is a tool used to move around records in the Aspect Property Manager. See Navigator Bar main topic.

Note

Additional information stored in the system and usually attached to a landlord, property, tenant or supplier. A Note is analogous to entries you make in your diary or a file such as your record of a phone conversation. A provision is made for "administrative" Notes too. See the Notes main topic and the Bring Ups glossary entry .

Numeric sequence

Records sorted in numeric sequence are usually sorted on the "code" associated with the item such as the landlord code, tenant code or may be on a number where that is a unique identification such as the transaction number in a report. The fact that you are seeing a number does not necessarily mean the field is numeric. Sorting on that field may not give you what you expect.

If the field is numeric, sorting on it will arrange the records in ascending numeric sequence, i.e. 1, 135, 1000. If the field is alphanumeric, sorting on it will arrange the records in ascending alphanumeric sequence, i.e. 1, 14, 115, 2, 2000, 3....

On some screens where data is arranged in columns, as on the main screens, clicking the column heading will sort the displayed information into the column sequence and clicking the heading again will toggle the sequence between ascending and descending sequence.

Compare to Alphabetic Sequence.

See Sorting Sequence for fuller discussion. XXXX

Top

O

Open Item

Open Item records are accounting records that remain in the system in their original form until they have all related processing completed. The details stay with the record through End of Period processing.

Open Item Examples

A tenant may have debts for water rates ($50), carpet cleaning ($50), and other damage repairs ($200), total $300, all entered in January. When viewed in any subsequent period, you will see those three items with any outstanding balance shown on each item until the month after they are fully paid.

In February the tenant paid $25 for water rates, $25 for carpet cleaning, $100 for repairs. In the March period you would see they owed - water rates $25, carpet cleaning $25 and repairs $100.

Compare to Brought forward.

Top

P

Paid To date

See Paid To date main topic.

Pane

A pane is used to describe a subdivision of a window. Funny that ! A pane is used where it desirable to group a number of items or where more information is available than can conveniently be displayed in the screen space available. In the latter case sliders and scroll bars allow viewing if additional data.

A pane can usually be resized by dragging the edge of the pane or the divider between the two panes. An example is the vertical divider on the Landlords screen which can be dragged to enlarge the Landlord Index pane to see more tabular details.

Partition

A partition is the term applied to an area on a disk that has a fixed size which usually can not be altered without difficulty. It may take up the entire disk or a disk may have several partitions set up on it. It inside these fixed capacity "buckets" that variable size directories are created and inside these are the program and data files.

In a Windows environment the partitions will typically be called by the disk drive letter "C", "D" etc. At least one partition will be set up automatically when the operating system is initially installed on the disk and they do not all have to be the same size and can even have different operating systems set up in each one.

Passwords

See Security and Passwords main topic.

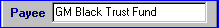

Payee

This is the name or identity of the "person" receiving the payment and will print on the Direct Credit List and Cheque List. and be in any electronic payment record.

When creating a landlord this field, found on the Payments Details screen, defaults to the first letter of the first name and the surname and for a supplier the name. The default may be over keyed.

The payee is located in Setup > Company Details for both the Fees and GST and Bond Disbursement payments and are pre-loaded with the demonstration system data which will need changing in a live system.

The entry is used as the Payee when generating payments or creating one manually except Tenant Payments when it defaults to the contents of the tenant's "Address To" field.

The default Payee may be changed on any payment record, (manual or generated), providing the payment has not been presented, along with any other details.

Payment Method

XXXX ???

XXXX ???

This indicates how the payment is to be made, or has been made and must be either cheque (CHQ) or Direct Credit (DC). If the method selected is DC, a valid account number must be entered. There is no mechanism to make payments by cash.

When new landlords and suppliers are being created the payment method on the Payment Details screen is defaulted to DC and the bank reference fields are picked up from the Setup > Company Details > Defaults tab. It will be necessary to enter a valid bank account number if you will be paying by electronic funds transfer. If paying by cheque change the payment method. When any payment is made to a landlord or supplier, the payment details including the payment method are all picked up from this record.

When a Fees and GST payment is made the payment details including the payment method are all picked up from the Set Up menu > Company Details > Payment Details page.

A Tenant payment can only be created manually and paid by either CHQ or DC.

A Bond Disbursement can only be created manually. Although both CHQ and DC are offered, in New Zealand, bond payments can only be made by cheque.

When creating a manual payment any details may be changed before saving.

On any existing Payment record, (manual or generated), providing the payment has not been presented, any payment details can be changed including the payment method.

As noted above when the payment method selected is DC a valid account number must be entered. However, when the method is CHQ the cheque number may be entered at or left blank. A blank cheque number has special significance, see Payments Overview topic.

Period

A Period is an arbitrary length of time in which transactions are grouped equating to an accounting period. There is no direct relationship with the calendar but typically will equate to a calendar month or thereabouts.

You may prefer to close each, or any, period on the Friday before the end of the calendar month rather than wait until the last calendar day. The ability to vary the period closing date is very useful around Christmas, and other holidays, when you can close the system off on, say, Tuesday, the 21st of December. This will get your landlords paid most of their rental income for December early and avoids the rush at the beginning of January which may also have extra work associated with dishonoured rent payments due to tenant over spending.

Each period is assigned a number which is increase by 1 each time the End of Period process is run. When performing the End of Period processing you will be asked for the date of the last day in the next period. See End of Period.

The only period in which transactions may be entered is the "current" period.

Portfolio

Portfolios are a convenient way of grouping properties together for administrative purposes. Properties may be grouped according to the manager responsible, perhaps using the manager's name as the portfolio description, or by location, suburb, or some other category. See the main Portfolios topic for more information on using and creating portfolios.

Press

See Click

Presented

This term is applied to receipts and payments in the system which have been matched against bank statement entries in the Bank Reconciliation process. Once presented a transaction can not be edited or deleted except by cancelling past reconciliations. The converse are "unpresented and unentered" transactions. See in the Glossary "U" section.

Preferences

The Aspect Property Manager has two distinct types of "preferences". System preferences are those which apply to every user of the Aspect Property Manager and should only be changed by the "system administrator" by whatever title they enjoy. Individual preferences, however, permit users to tailor the way the Aspect Property Manager appears on their computer. Examples of system preferences are the way the company name and address appears on letters and the location of specific directories and files. Individual preferences include the size and placement of the Aspect Property Manager windows (screens) and whether those settings are "remembered" from one use to the next. Individual preferences are usually associated with a particular person's logon on computer used.

Printing the Screen

On most screens the menu bar will have a [PrintScreen] entry which invokes the Aspect Property Manager printing function which will print the screen you are viewing. If the menu bar or entry is not present this can also be invoked by pressing Ctl+P.

Program

See System or Program Make your own choice

Property Code

Each property has a unique four digit system assigned code allocated when the property is created. There is no relationship between the landlord code and the property code or the tenant code. Do not try and use the same code for the landlord and property and tenant, unless you have a really compelling reason. Attempting to apply the same code to the landlord, property and tenant falls apart the moment the landlord has multiple properties and when the original tenant vacates and a new one moves in. You can not have multiple landlords, properties or tenants with the same code.

When creating a new property you may override the system assigned code before saving the details. Alternatively use the Properties menu > Renumber Property function.

Top

Q

R

Recalculate (Rent Invoices)

This is a process which is invoked by the system caused by any change you make which affects the amount of Rent a tenant has to pay.

It can also be initiated manually by selecting Tenants Transactions > Recalculate.

See Recalculate Rent Invoices.

Reconciliation

Reconciliation is the process of checking that the result of the monetary transactions made in the computer system, namely the system bank balance, exactly matches the result of the transactions that occurred in the "real" bank account as shown by the Bank Statement balance.

The fact that the system reconciles does not necessarily mean the transactions have been posted to the correct account. Eg - The system will still reconcile if rent was credited to the wrong tenant/landlord. See Bank Reconciliation topic.

Reference (number)

This is a manually entered external reference for this transaction and is typically a receipt number, a bank statement page number, invoice number or some other reference to hard copy data to which this transaction relates. The reference may be numeric or alphabetic and is not the system generated transaction number.

When entering a receipt, the reference will increment by one if the previous entry was a number. See Tenant Receipt.

Remark

Refer to Internal Comment

Rent amount

The rent required for the period displayed in the rent period box.

If the rental agreement states $400 per fortnight enter 400 and choose fortnight as the rent period. Do not enter $200 per week or your tenant will continually appear on the arrears report..

Note

The Aspect Property Manager requires the full rent amount to be received before the Paid To date is changed. Paying two days' rent will not change the Paid To date, but will record a credit amount towards the first unpaid period.

Remittance Advice

Whenever you make a manual payment by cheque or DC the system will optionally print a Remittance Advice, formatted to fit a window envelope, detailing the method of payment, cheque or DC, the cheque number (if entered) or the bank account number credited and of course the amount being paid. Some of the generated details may be changed and further comments may be made in the Details box. If the Amount shown is wrong you have entered the incorrect value when creating the payment and you will need to edit the payment and print a new remittance advice.

Print the remittance advice to the screen first then if any details are wrong you can return to the Print Remittance Advice screen and make changes. (Amount excepted).

The Bond Remittance Advice lists the name and address and bond amount of all the tenants being paid by the payment. Print two copies and attach the bond forms to one copy for mailing. File the other copy. If you need to delete a bond payment the remittance advice can be reprinted by first selecting any transaction line included in the bond payment then Reprint Remittance Advice from the Print menu.

The Fees and GST Remittance Advice shows the individual management fees, letting fees and GST amounts which make up the payment. Print and file.

A Landlord or Supplier Remittance Advice is not printed for payments made in the bulk Generate Payments runs with the exception of the Fees and GST payment. The landlord and supplier statements are intended for this purpose.

Rent Inv records

A series of records in the tenant accounts which show the amount of rent the tenant is to pay, when it is to be paid and what period of time is being "bought".

See Tenant Rent Inv topic.

Rent period

This is the length of time payment of the Rent Amount "buys" and is defined by the rent From and rent To inclusive dates. It should usually be the same period as on the rental agreement.

Top

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z