Text and Memo Fields

First.....Prev.....Next.....Last

As well as the Reference field all transaction records have two further fields which act as "aide memoir", Text and Memo, into which comments can be entered about the transaction.

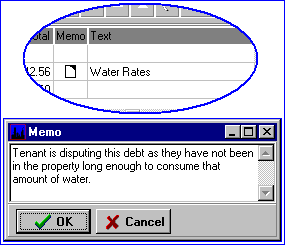

When [Transactions] on any of the four main screens is pressed the transaction grid is displayed and any entry made in the Text field can be seen in the "TransText" column.

Any transaction containing an entry in the Memo field displays a Memo Icon  in the "Memo" column. Clicking the icon displays a small window showing the full memo.

in the "Memo" column. Clicking the icon displays a small window showing the full memo.

Enter information that will help months down the track. Don't waste your time entering patently obvious details such as "Invoice from electrician" when the supplier is Sparks Electrical.

Similarly, when entering an invoice putting "Replace stove element"in the Text field is much more informative than just "repairs". Since the invoice Text field prints on the landlord's statement it might save you a phone call or two as well. To provide fuller details make an entry in the Statement Message, see Landlord Payment Details .

Text and Memo entries can be made while creating a new transaction. Editing them in an existing transaction can only be done in the current period providing it has not been presented. The exceptions are those transactions which do not affect the system bank balance - tenant Rent Inv, Debt and Bond Transfer records and supplier Invoices. Don't raise your eyebrows see the Transactions and Accounts section of the Accounting Primer topic. Memos, however, can always be accessed from the transaction grid regardless of period, record type or presented status.

Text Field

This is intended for a brief comment limited to 30 characters which is printed on reports used for both internal and external consumption. It cannot be stopped from printing on reports which go "outside" the organisation such as landlord statements and the entries are lost when transactions are deleted. Compare to Notes.

In an invoice the header text can be different to the line item text. It is the invoice line item Text which prints on landlord statements.

Text field contents can be generated by the system and may not always be editable. As an example, after Generate Payments the Text field in a Bank Transactions record contains "L 1003 Payee Mr A Molina" indicating a payment from landlord 1003 to a payee Mr A Molina.

Where there is a "big story" enter "Glass repairs. See Memo" and enter the gruesome details there.

Memo Field

A memo is a longer comment about the transaction and normally meant to be internal to the organisation and has no practical size limit. You can write a book. They may be displayed on some reports which go "outside" the organisation when specifically requested, for example the Tenancy Tribunal Report. For this reason, when there is something "non-standard" about the transaction, it is worth spending a little time when creating transactions to enter something, rather than spend many hours later working out what happened, or having an argument about who said what.

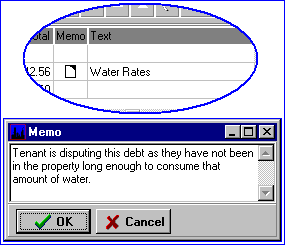

Memos may also be added or edited by clicking the empty Memo cell or  icon in the transaction grid providing access to transactions which may no longer be edited. The memo window which opens is automatically in edit mode and you may add, change or delete information. Click [OK] to save any new details added or [Cancel] to leave the memo as it was when opened. Empty Memos "disappear" and regardless of content are lost when transactions are deleted. If a memo contains only carriage returns will appear empty but continue to display the icon. Compare Memos to Notes.

icon in the transaction grid providing access to transactions which may no longer be edited. The memo window which opens is automatically in edit mode and you may add, change or delete information. Click [OK] to save any new details added or [Cancel] to leave the memo as it was when opened. Empty Memos "disappear" and regardless of content are lost when transactions are deleted. If a memo contains only carriage returns will appear empty but continue to display the icon. Compare Memos to Notes.

Memo comments entered against transactions can be most useful in the case of a dispute, so they are worth entering when the event happens rather than relying upon memory.

Examples

A tenant debt transaction memo could contain a list itemising the cost of damage for which the tenant is liable.

If a tenant paid the rent in gold Kruger Rands, or $500 in 50 cent pieces then a novelette might well be in order.

Related Topics

Exercise section of the Speed Keys topic.

Notes