Landlord Transactions

First.....Prev.....Next.....Last..

Location... Landlords main screen > Transactions button

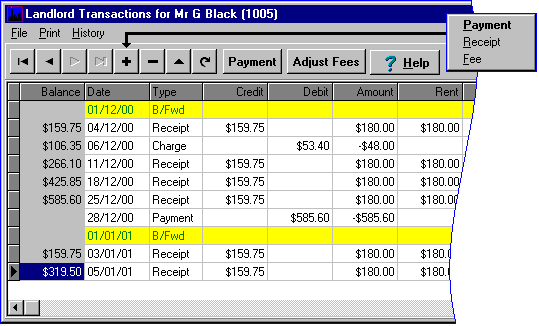

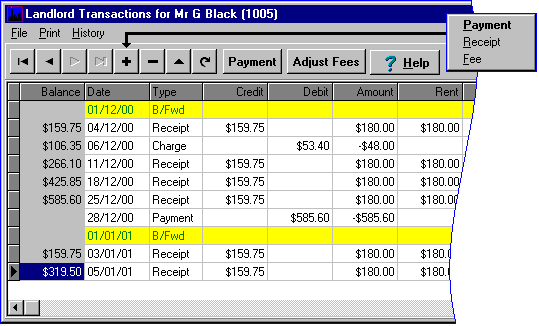

Section of Landlords Transactions grid

This topic only deals with items unique to landlord transactions.

See the main transaction topic for common items.

Transactions seen in this grid are :-

4 B/Fwd records.

4 Receipts for rent received and debt repayments made by tenants.

4 Receipts direct into the landlord's account usually from the landlord to pay for repairs not covered by the rents received.

4 Charges for expenditure on the landlord's property(ies).

4 Charges not attributable to a property and charged direct to the landlord.

4 Payments made from the landlord's account.

4 Fee only transactions consisting only of Fees and GST.

4 Tenant Payments made for the reimbursement of overpaid Rent or Debt.

B/Fwd

There is a B/Fwd record at the start of each period.

The first one in any account is created when the landlord is added and a new one is created during the End of Period processing.

Its content will most commonly be set by the End of Period processing where balances and dates are carried forward.

When setting up a new system opening balances and other data may be entered using the Landlord Opening Balance program.

Receipt

Receipts may be via a tenant account or direct into the landlord account.

Receipts which pass through a tenant account will show the amount of the rent received or debt repayment and will have tenant and property details on the grid line.

Receipts which do not pass through a tenant account but are direct into the landlord account will most often be for money received from the landlord for property repairs, rates etc and will have no tenant and property details on the grid line.

There will be other sundry receipts from time to time which will need to be entered as a landlord receipt simply because it should not affect any tenant's rent or debt status.

Receipts may have the system calculated fee overridden via the [Adjust Fees] button. See Editing below.

Landlord receipts do not have any fee calculated but one may be entered when entering the receipt.

Charge

Charge records represent one line item from a supplier invoice and may "pass through" a property or be charged direct to a landlord.

Charge records for expenditure on the landlord's property(ies) will have property details on the grid line.

Charges not attributable to a property and charged direct to the landlord will have no property details on the grid line.

Payment

In general the only person paid from this account should be the landlord. There are a couple of exceptions one of which is when reimbursing a tenant for work done on the property. If the tenant is to receive the money make a payment by cheque or DC with the tenant as the Payee. If the tenant is not receiving the money but is being given "rent relief" make the payment by DC, change the Payee to the Tenant, enter your trust account number in the Bank Account Number field and receipt the same amount as Rent in the tenant's account. This way you won't miss your fees.

Tenant payments will also appear in the grid when the tenant is being reimbursed for overpaid rent and debt, but the transaction is not editable.

A tenant payment is identifiable by having the tenant's details on the grid line.

General and "Rules"

A tick in the Fee Override column indicates a manual adjustment has been made to the system calculated fees.

The Balance column shows what is owed to the landlord after fees have been deducted.

The last row Balance is what would be paid out, less any Hold Amount, by Generate Payments.

The Amount column shows the gross value entering or leaving the account without any fees adjustment.

The Net column shows the amount after fees have been deducted for receipts and added for charges.

The value in the Fees column is excluding GST.

Adding Transactions

Most receipts will be added by tenant receipting.

You can add a landlord Receipt manually for money to be receipted into a landlord's account which is not from a tenant, for example money from the landlord to cover charges for property repairs which can not be met from rent.

Most payments will be added by Generate Payments.

You can enter a manual landlord Payment when it is necessary to make an "emergency payment" to a landlord.

Fee transactions permit you to "charge" the landlord for some service, or to return fees which should not have been charged. See Landlord Fee Transaction.

Editing Transactions

Past period transactions are generally not editable.

Presented receipts or payments are never editable.

The [Adjust Fees] button allows you to alter the fees charged on a receipt in the current period only, even when the transaction has been presented.

Adjustment to fees in past periods must be done by adding a new Fee transaction in the current period with the appropriate sign.

Reversing Transactions

See Transaction Reversals temporarily. XXXX

Deleting Transactions

Not all transactions can be deleted in the landlord grid.

Past period transactions are generally not deletable.

Presented transactions are never deletable.

Deleting a tenant receipt affects the tenant's rent details and would generally be better deleted from the tenant transaction grid where you can see what happens.

Deleting a landlord receipt affects only the landlord's balance, and Fees and GST if taken.

Deleting a landlord payment puts the money back into the landlord's account and the system bank.

Deleting a Fee transaction will increase or decrease the landlord's balance by transferring funds from or to the Management Fees and GST control accounts.

Charges can only be deleted from the supplier transaction grid. See Supplier Transactions.

It is best only to delete current period transactions otherwise past period reports will be wrong.

Where past period transactions are involved it is better to reverse them. See Transaction Reversals

Clearing a Landlord Account

When you are no longer dealing with a landlord you should have settled their account at the time the management was lost. If they had been overpaid you must either recover the over payment from them, or put your hand into your Fees and GST or trading account and return the overpayment to the trust account to achieve a bank reconciliation and a clear account. If there is a positive balance a payment to the landlord should be made.

In the event you do not have a forwarding address you will need to make a management decision as to what to do. If there is absolutely no possibility of paying the landlord and you leave the money in that landlord account it just clutters up the trust account. You could make a payment to your trading account, or enter a Fee transaction for the balance but you may need to refer to your bylaws for guidance.

If you have overpaid the landlord, instead of writing a cheque from your trading account you can transfer money from the Management Fee and GST accounts to the landlord's account by using a Fee transaction. Enter the fee to be returned to the landlord as a negative value and make adequate entries in the Text and Memo fields. This transaction (I hope) obviously will affect the management fees collected for the month and will also affect any commissions paid based on those fees.

You should clear an account as soon as practical after the management has concluded as it has a direct bearing on how soon the landlord account can eventually be purged and deleted from the system. See Purge

Related Topics

Transactions

Add, Change and Delete Records

Landlord Receipt

Tenant Receipt

Landlord Payments

Landlord Fee Transaction

Landlord Adjust Fees

Purge