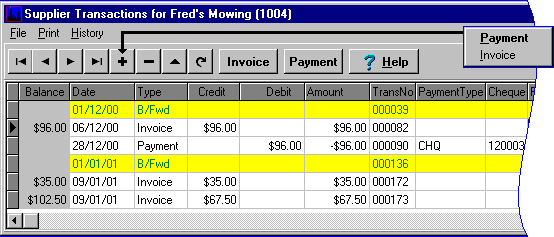

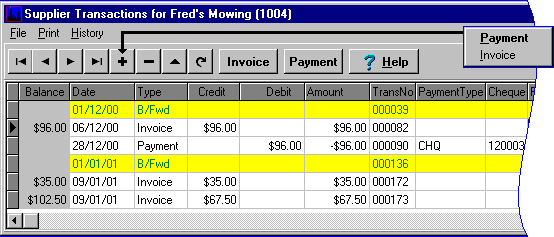

Supplier Transactions

First.....Prev.....Next.....Last

Location... Suppliers main screen > Transactions

Section of Properties Transactions grid

This topic only covers items unique to supplier transactions.

See the main transaction topic for common items.

Transactions seen in this grid are :-

4 B/Fwd records.

4 Invoices for expenditure on the landlord's property(ies).

4 Payments made to the supplier.

B/Fwd

There is a B/Fwd record at the start of each period and should be the first record in the grid.

It was created when the supplier was added, or has been left when the Archive process stripped off the prior period transactions.

Its content will be set by one of the following :-

4 The End of Period processing. (Most common).

4 The data entered in the Supplier Opening Balance entry screen. (Only when setting up a new system).

Invoice

The invoice records represent one supplier invoice.

Each invoice may contain multiple line items for one or more properties.

Each line item may "pass through" a property or be charged direct to a landlord.

Each line on the invoice becomes a "Charge" record on the landlord's transaction grid.

Payment

All payments to a supplier should be made from this account and not from a landlord account.

Adding Transactions

Depending upon volume you may add invoices in bulk from Suppliers menu > Invoices.

Or, you can add a supplier invoice from the supplier transactions grid  or

or  buttons.

It is intended that the system Generate Payments process is used to pay your suppliers but you can pay them manually from the

buttons.

It is intended that the system Generate Payments process is used to pay your suppliers but you can pay them manually from the  or the

or the  buttons.

buttons.

Editing and Deleting Transactions

Past period transactions may be edited and/or deleted with the exception of presented payment transactions.

Editing or deleting invoices will affect both the landlord and supplier balances but have no affect on the reconciliation of the system. See Bank Reconciliation.

It is best only to delete current period transactions otherwise past period reports will be wrong.

Where past period transactions are involved it is better to reverse them. See Transaction Reversals.

Deleting a supplier payment puts the money back into the supplier's account and the system bank.

Reversing Transactions

See Transaction Reversals temporarily. XXXX

Clearing a Supplier Account

When you are no longer dealing with a supplier you should have settled their account . If they had been overpaid you must either recover the over payment from them or put your hand into your Fees and GST or trading account. If there is a positive balance make a payment out of the account to the supplier.

If you have overpaid the supplier, instead of writing a cheque from your trading account you can transfer money from the management fee and GST accounts to the supplier's account. Do so by creating a zero value supplier invoice, select your Unidentified Items landlord account, tick the Fee Override, enter the fee to be returned (excluding GST) as a negative value and make adequate entries in the Text and Memo fields. This has no financial effect on the Unidentified Items account although a zero value charge record will appear.

If you sever relations with a supplier you should clear their account as soon as practical as it has a direct bearing on how soon the supplier account can be purged from the system. See Purge.

Related Topics

Add, Change and Delete Records

Transactions

Purge