The system now presents the standard Tenant Debt creation screen for each line item where you have indicated a charge is to be made to the tenant. The tenant selected and the Debt amount field will contain the entries made in the invoice line item. Both may be changed as required, and the amount may be converted into a schedule of debt repayments. There is no check on the relationship between the invoice line item amount and the value entered in the Tenant Debt screen.

If you wish to split the debt across multiple tenants do one tenant debt now and use the standard Tenant Debt screen to add the other debt(s) after completing the invoice entry task.

As each tenant debt is created you may print a Tenant Invoice and/or a Tenant Statement, both of which are suitable for a window envelope. See Tenant Debt Screen.

Editing and Deleting

While the invoice is still in the bulk receipting grid click

You can not normally edit or delete past period invoices. See Add, Change and Delete Records.

The Aspect Property Manager will allow you to change the invoice amount or the line item distribution within an invoice, or delete the invoice if necessary. These actions will affect the landlord and supplier accounts but have no effect on the tenant debt entries. Go to the tenant transaction grid and delete or amend any related debt record there.

When an invoice is edited there is nothing to indicate any previous tenant debt charging you may have made so take care NOT to enter the tenant debt a second time or you will double bill the tenant. You can add new debts if you missed doing so before.

If a tenant debt needs adjusting go to the tenant transaction grid adjust the debt record there.

If an invoice is deleted go to the tenant transaction grid and delete any related debt record.

Discussion

To be able to pay a supplier for work done on behalf of a landlord you must have created a supplier so you can enter the invoice and collect your fees.

Supplier invoices should be entered for any transaction which the landlord is going to pay whether or not the tenant will reimburse all or part of the account. Thus items like water rates, lawn-mowing and so on, which you are going to pay and then recover from the tenant fall into this category.

If you receive a bill and pass it on to the tenant for them to pay directly to the supplier do not enter it into the system as a supplier invoice nor as a tenant debt because you will not be passing any money through the trust account. By all means put a bring-up note in the system so you can check it has been paid, but that is all.

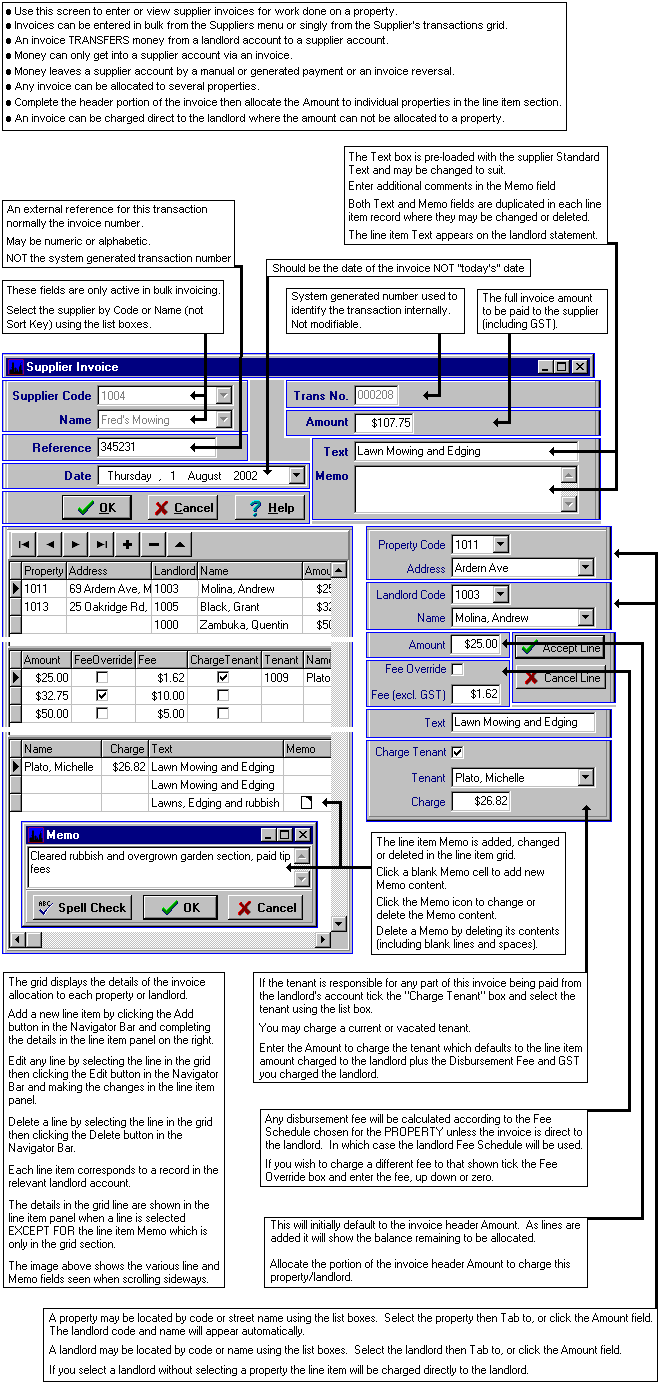

Entry of the invoice consists of several distinct stages. In the first, you select the supplier, then enter an invoice "header" which contains the general details, invoice number, total charge, etc. The standard invoice text from the supplier's record is displayed in the header Text field and may be overridden. This text will automatically transfer to line items in the invoice entry and to the subsequent tenant debt creation process. Details entered in the memo box are not transferred.

The next stage is to allocate all or part of the charge to either, a property and therefore indirectly to a landlord, or directly to the landlord. This is the point where you can spread the invoice across a series of properties and landlords by creating a line item for each separate charge. The system calculates a disbursement fee and GST on each invoice line item value which you may override if you wish. There must be at least one line item per invoice. The value of the line items must add to the invoice total.

Each line item has text and memo fields and you should use these to describe the reason for the charge. The text field will contain the entry made in the invoice "header" and may be changed to be specific to this property. It will appear on the landlord's statement so it should be pertinent. Memo additions, deletion or changes are made in the line item grid itself via the active Memo cell.

When entering each line item you may choose to charge the tenant if they are to pay for the item being entered. The default amount is the line item amount plus the landlord fee plus the GST on the fee which may be changed. You may select the current or a vacated tenant and charge any amount which should include any GST component. The entries made on the line item are later transferred to the standard Tenant Debt screen

The Aspect Property Manager now does some checking and you will be warned if the invoice total plus fees and GST exceed the landlord's balance, or if the total expenditure for the period, including this invoice, exceeds the disbursement limit on the property. It is a warning only and you may proceed or abandon the invoice entry. Which you do is your choice. Our opinion is that you should enter the invoice regardless of the warning with a couple of provisos. See "When to enter invoices" below.

Occasionally you may get a supplier invoice which can not be allocated to a specific property but is charged directly to the landlord. If this is the case and you need to charge a tenant you can select the tenant using the usual tenant charging procedure or create a tenant debt manually using the Tenant Debt Screen.

Important Concept

When you enter a supplier invoice the total value of the invoice plus fees and GST is immediately deducted from the landlord's account. The invoice value is transferred into the supplier's account, the disbursement fee into your management fee account and the GST into the GST control account.

Paying the invoice

Invoices may be paid by cheque or direct credit using either manual or bulk payment methods. See Supplier Payments for a full discussion.

When to enter invoices

As stated above, we believe an invoice should be entered into the system as soon as you have authorised its payment. The circumstance will vary from case to case but consider the following arguments:-

1. If the invoice is in the system the money has been transferred out of the landlord's account and into the supplier's account. You can not accidentally pay the landlord more than you should have because the invoice is still in a folder on your desk.

2. If the landlord's balance is insufficient to cover the total charge, by entering the invoice you "reserve" the next incoming receipts to pay the invoice. If you don't put it in the system you have to remember about it.

3. If the system reflects what the true situation is vis a vis the landlord's account you know where you stand. If you rely on memory you will make mistakes. In large operations there may be several people dealing with the account so the possibility of error is much higher.

4. Yes, you run the risk of paying a supplier with money the landlord does not have. But if you are managing the property properly you should have ensured the landlord was able to pay before the work commenced or the rents for the period would cover the bill. If not, the landlord should be sending you a cheque. He has responsibilities for his property too.

5. If, at the end of the period, the landlord's account is still in O/D, and you have an auditor who will not accept any individual landlord account being overdrawn then simply reverse the transaction before doing the landlord payment run. Make sure you put a Hold Amount on the landlord's account that covers the bill though.

6. About the O/D bit. There is a fair range of interpretation by auditors on trust accounts being in O/D. Some, as suggested above will not tolerate even one landlord account being O/D. Others accept the facts of life and say the whole trust account must not be in O/D. The question now is "Is that the system bank account or the 'real' bank account?"

7. You can ensure the 'real' bank does not go into O/D by not withdrawing all your Management Fees at a period end. Leave a float for a few days until the incoming rents have all outstanding payments covered. By paying your suppliers a few days into the new period you can achieve the same result. See Supplier Payments.

8. Whether the incoming invoice exceeds the permitted expenditure amount or the landlord balance or not, is really immaterial. The bill has to be paid sooner or later and there is no way at all the system could have stopped you exceeding any expenditure limit. You should have checked the situation before authorising the work. The "expenditure exceeded" and "insufficient funds" warning, however, do give you a "face-saving" opportunity so you may contact the landlord before the statement arrives and they ring you.

9. If you don't wish to pay the supplier you can enter a Hold Amount on the supplier account for the invoice value or the portion in dispute.

Related Topics

Supplier Transactions

Supplier Payments

Tenant Debt

Bulk Payments