Bank Reconciliation XXXX Revise

First.....Prev.....Next.....Last

Theory

For the purpose of this topic:-

"bank statement" is used to mean any form of bank report which provides a list of transactions and an associated balance.

"end of month" means the end of the accounting month which may not necessarily be the last day of the calendar month

Reconciliation is the term given to checking that the monetary transactions in the computer exactly match the transactions that occurred in the "real" bank account. It is achieved by comparing the "system" bank balance and the bank statement balance and making adjustments for unpresented items.

It is essential that the time frame being compared is the same. You can not directly compare a system bank figure which includes transactions up to and including the 31st of the month with the balance on a bank statement that stops on the 27th of the month. Account must be taken of those transactions occurring after the 27th which affect the system bank and will be reported on a subsequent bank statement.

Similarly because the Property Management is period oriented and has no particular "close-off" date you need to ensure that reconciliation covers the same period.

The fact that the system bank reconciles with the "real" bank does not mean the transactions have been assigned to the correct landlord, property, tenant, supplier, etc. Accuracy of entry is a requirement the user must meet by checking various reports and the use of plain common sense.

The general process required to reconcile the Trust Account manually is discussed first followed by a section on troubleshooting and finally the use of the built-in bank reconciliation. It is assumed that the person performing the reconciliation is adequately trained and familiar with accounting functions. My advice with reconciliations is little and often. If a reconciliation is done every time you enter details from a bank statement the reconciliation should be fairly straightforward and you have just the few recent transactions to consider when it's not right.

Please remember that the only transactions which directly affect the real bank account are deposits and withdrawals which in the Aspect Property Manager bank account are receipts and payments respectively. This means only those transaction types are considered in the reconciliation process. All other transaction types play no part in the bank reconciliation.

If the system does not reconcile, find and fix the problem before entering more transactions, but, before you "fix" a problem, make sure that you do have a problem and you know how it shows up in the system. Think through how you will fix it. If you can't work it out manually, "chucking it at the computer" probably will not fix it either. After doing the correction, check that the "fix" did what you wanted. If you are unsure try the fix in the Training module. In the real life reconciliation problems we get involved with, often the problem is the result of mistakes which have not been corrected in the right way, including entering "fixes" to problems that never existed.

Manual Reconciliation

Before you can start using the in-built bank reconciliation you must be able to reconcile the system manually. This section shows my routine to perform a manual reconciliation. Other methods may be equally valid.

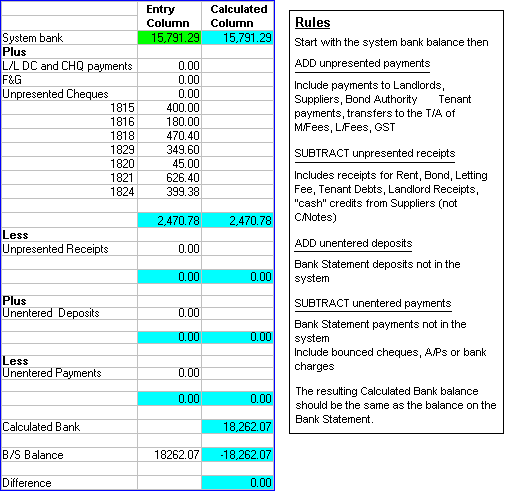

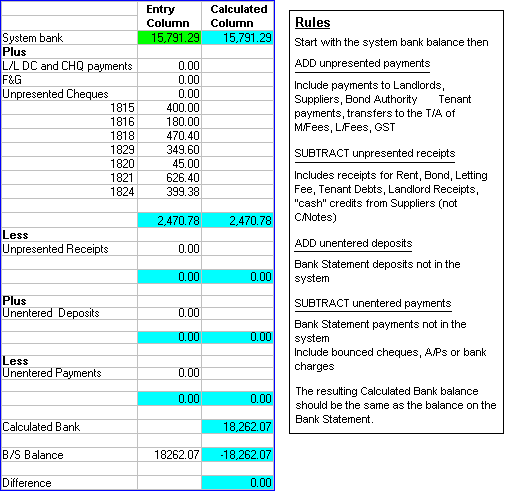

Reconciliation is performed by starting with the "system" bank balance figure then making adjustments to it by adding or subtracting items which do not appear in both the system and on the Bank Statement.

These items are termed unpresented items and may be:-

Unpresented Payments.

Unpresented Receipts.

Unentered Payments.

Unentered Receipts.

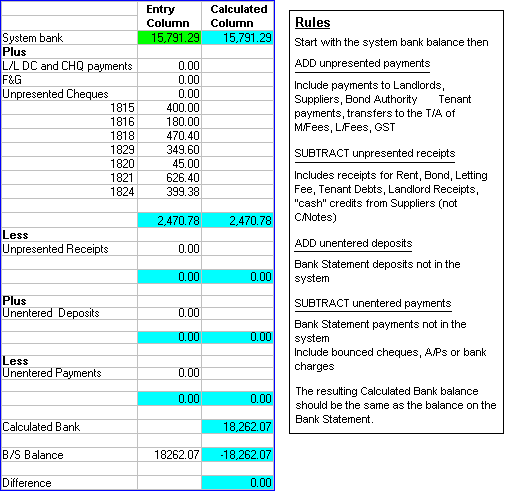

Make up a form or use a spreadsheet as shown in the next image and follow the "Rules".

If you really want to persist with manual reconciliations then as an aid to the reconciliation process you should do the following:-

Reconcile your system every time you enter details from the bank statement.

Get the month's last bank statement as soon as possible after the end of the month or get a printout of the transactions since your last statement so you can reconcile before you perform the End of Period processing.

Have your bank statements issued regularly throughout the month and check the transactions off against :-

4 your cheque and deposit books

4 your direct credit schedules

4 system reports such as the banking list, audit trail, transaction report etc.

4 making sure the values are the same in both/all places

Avoid issuing cheques over the last few days of the month so that most if not all issued cheques will have been presented by the time the "end of month" bank statement is printed.

Troubleshooting

When you can not reconcile it is because transactions in the system and those on the bank statement do not match. The values could be different, a transaction could be duplicated or even missing completely.

First check your reconciliation calculations

Ensure you are comparing transactions covering the same period

Check you have taken into account all

Unpresented Payments.

Unpresented Receipts.

Unentered Payments.

Unentered Receipts.

Check any "unusual" transactions you may have made, especially those you did to fix something.

If the balances still do not match examine all transactions since the last time they were in balance. Use the Cash Book and Audit Trail reports to compare to the bank statement entries.

Look for:-

Missed transactions

Transactions entered twice

Transactions entered incorrectly - figures transposed

Cash transactions entered into the system as "two" cents but actually received and banked as "zero" or "five" cents.

If the balances still do not match check that your previous reconciliation does still balance by doing it again and start the process all over again.

When re-doing reconciliations don't just pick up figures off old reports as they may have changed. Re-check them with what the system says now.

If you have modified or deleted transactions in prior periods this may have thrown out your previous reconciliations too. Examine your Audit Trail and Cash Book reports for this period to see if you have deleted a prior period transaction and re-entered it in the current period. They will be at the top of the report if dated correctly.

As a general rule it is better to reverse a bad transaction rather than deleting it. XXXX ???? >>> See Transaction Reversals. Primarily because you leave a paper trail of what actually happened. As a general rule reverse the complete transaction and reenter it. Don't make entries for just the bit that is wrong. If you are using the internal bank reconciliation you will not be allowed to change or delete presented transactions and will have to reverse or them or cancel then repeat the reconciliations involved.

Internal Reconciliation

The built-in reconciliation eliminates much of the hard work associated with a manual reconciliation and definitely eliminates new errors introduced by getting the "checking" numbers wrong.

The monthly Audit Return can only be printed if the in-built reconciliation process is used. This saves even more time.

The reconciliation process will not work unless ALL Receipt and Payment TRANSACTIONS are entered into the system including unidentified deposits, bank charges and any other miscellaneous items which appear on the bank statement whether they should be there or not. To this end create the "Unidentified Items" and "Bank Charges" special landlord accounts if you have not already done so. Enter any unidentified item or bank charge into the appropriate special account remembering that the entries should always be positive or negative value receipts thus:-

Receipts/Credits/Deposits should be entered into the system as a positive value receipt and reversed out as a negative value receipt, not a payment.

Payments/Debits/Cheques should be entered into the system as a negative value receipt and reversed out as a positive value receipt, not a payment.

When you have entered an unidentified deposit in the Unidentified Items account that transaction will be used to reconcile the to the bank statement balance. When you correct the problem you will have a negative value receipt in the Unidentified Items account and a positive value receipt in a tenant or landlord account. These last two items need to be presented together as they cancel each other out. By using the same transaction date as the original transaction they will appear on most reports beside or very close each other unless they are in different periods.

Note that "unconfirmed" payments will appear on the Bank menu > Bank Reconciliation Report but will not be present on the Bank menu > Bank Enter Bank Statement Details screen.

Worked Example

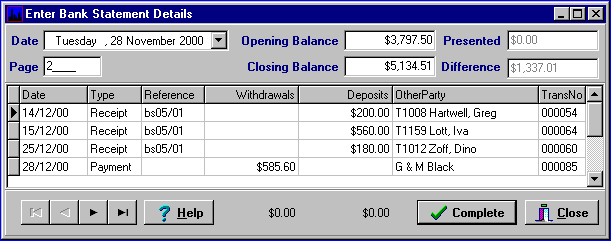

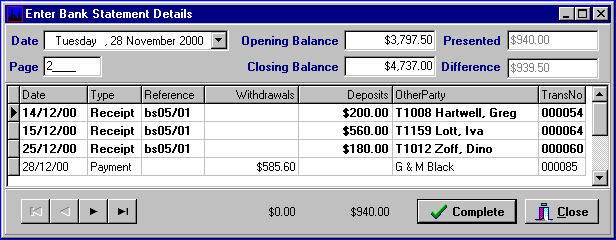

Location... Bank menu > Enter Bank Statement Details.

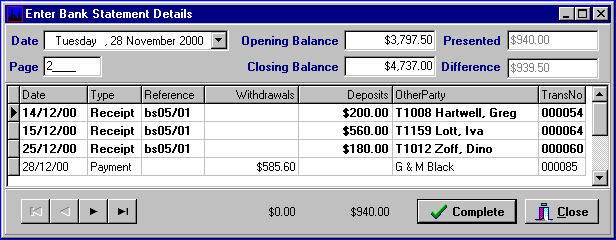

The three receipts have been entered from the bank statement and need to be "ticked off" as having been presented to the bank.

Double-click each line to select or deselect a line.

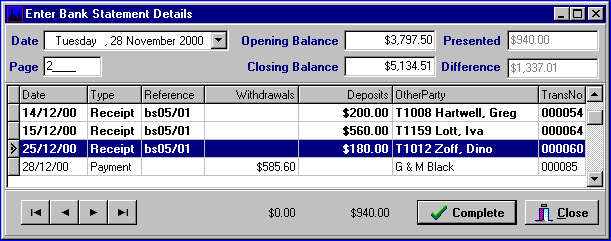

Presented lines are bold.

The Presented field now contains the total net value of the items, receipts and payments, that have been selected for presentation.

Enter the bank statement balance in the Closing Balance field.

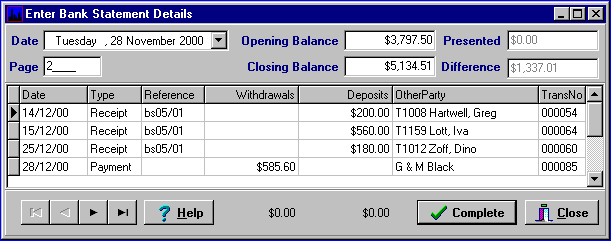

In this case I have made an entry error of 50 cents.

The Presented field now contains the total net value of the items, receipts and payments, that have been selected for presentation.

Enter the bank statement balance in the Closing Balance field.

In this case I have made an entry error of 50 cents.

Because the Presented and Difference values are not equal it means:-

Because the Presented and Difference values are not equal it means:-

4 there is an incorrect selection of presented items.

4 there are incorrect, missing or extra transactions in the system.

4 or, as in this case, the closing balance is incorrectly entered

The options now are to scan the selections to see where the error is or click the Close button and print the Bank Reconciliation report to do further checking. The items which have been selected will be remembered when you return to the Enter Bank Statement Details screen.

If you click the Complete button when the Presented and the Difference values are not equal an error message will appear and you can only exit via the Close button.

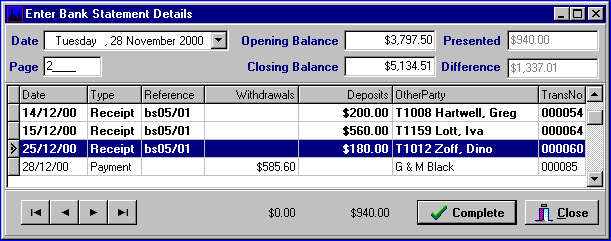

When the problem has been fixed and the Presented and the Difference values are the same the system now reconciles to the bank statement balance and Complete can be pressed.

Notes

Once a transaction has been presented you can not edit or delete it. It can only be reversed in the current period. However, you can cancel each bank reconciliation by working backwards one reconciliation at a time until the transaction is no longer presented then edit or delete it. You will need to re-present all cancelled items again of course but this can be done as one large reconciliation. Print the Bank menu > Bank Reconciliation Report first so you have a list of the unpresented items.

Consider doing the reconciliation at the end of each bank statement page then you know any discrepancy is on the page just entered rather than searching through "ten" pages of A/Ps.

Receipts

Receipts which have been entered as A/Ps or EFTPOS will be shown as individual items while those entered as cash or cheque and have not been "Marked as Printed" on a Banking List will be shown as individual items.

Receipts which have been entered as cash or cheque and have been printed on a Banking List will be shown as a single value with the Banking List number in the Reference and Transaction number columns. When using the Banking List it is important to correctly enter the type of money received, i.e. A/P, cash, cheque or EFTPOS when receipting. If you do not, the "lump sum" value shown on this screen will not match the sum shown on the bank statement and reconciliation will be vary between difficult and damn near impossible.

Payments

Payments will not show on the Enter Bank Statement details grid unless they are "Confirmed".

Manual Cheque payments will always show as individual items but will only appear on the Enter Bank Statement details grid if they have a Cheque number entered.

Individual manual DC payments will only appear on the Enter Bank Statement details grid if they have been confirmed.

Generated DC Payments will never be seen as individual items in the Enter Bank Statement details grid because when they are confirmed they become a "batch" whose total appears as a single value which should match the bank statement figure.

Individual manual DC payments may be drawn together into a generated batch in which case the make up part of the DC batch total.

For more information see Payment States,and More On Payments And Reconciliation in the Payments Overview topic.