Banking List XXXX

First.....Prev.....Next.....Last

The Banking List function is most useful to users who regularly handle a reasonable volume of cash and cheque receipts. Its primary use is to print a schedule of deposits which is then attached to your bank deposit slip, thus saving the time involved in writing out the cheque details and adding the list of cash and cheques to be banked. It also records EFTPOS transactions for completeness.

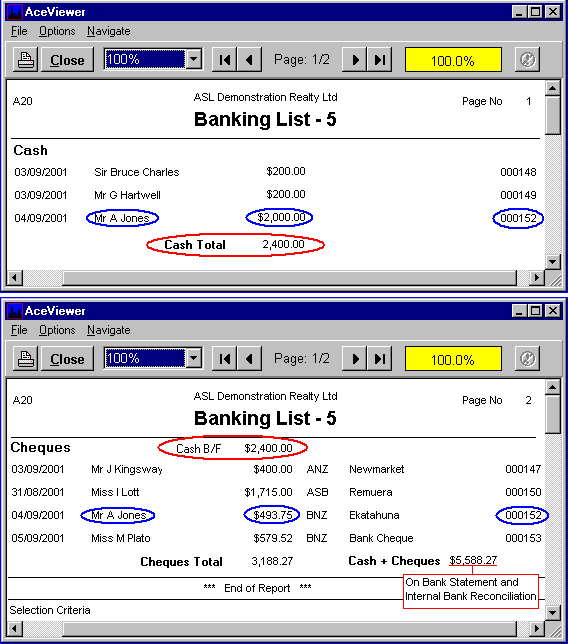

A batch number is assigned to a Banking List and is used in the bank reconciliation process to draw into a single figure all the individual cash and cheque receipts which made up that banking. A match can now be made between the single bank statement amount and the same figure shown on the Enter Bank Statement Details screen. The EFTPOS transactions will show as individual amounts.

You must be the judge of "a reasonable volume", but even if you don't use the printed output you can still print the Banking List to take advantage of the grouping function with bank reconciliation as well as having a breakdown of the lump sum on the bank statement.

Organisations which do not record "over the counter" receipts until they appear on the bank statement can use it as a checking mechanism to check all non-DC receipts do appear on the bank statement.

To effectively use the Banking List a routine needs establishing whereby, at a particular time of day, entry of new receipts is temporarily stopped and the Banking List is printed. See Daily Processing in Periodic Processing.

The functions associated with the use of the Banking List are covered below.

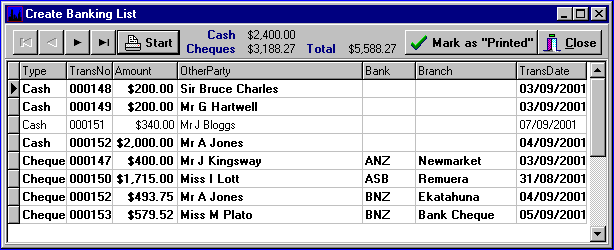

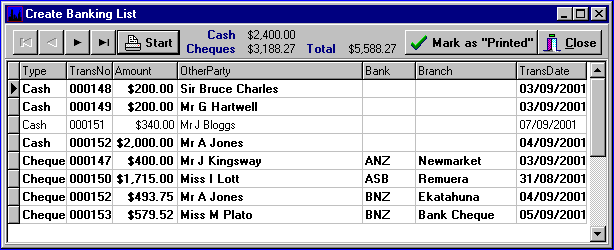

Create Banking List

Location... Bank menu

When invoked this screen first displays a list of all cash, cheque and EFTPOS transactions that have occurred since the last time the report was printed.

All lines will be in bold text signifying they are to be included in the next banking but where an item is not to be banked for some reason double click the line to make it non-bold. The unselected lines will not print this time but will display next time the Banking List is run. Double click again to reinstate the line. Right-mouse clicking the grid displays a sub-menu of selection shortcuts.

EFTPOS transactions would normally be left bold since the money is already in the bank. They are only printed as part of the banking list for completeness as they identify "money" passed over the counter.

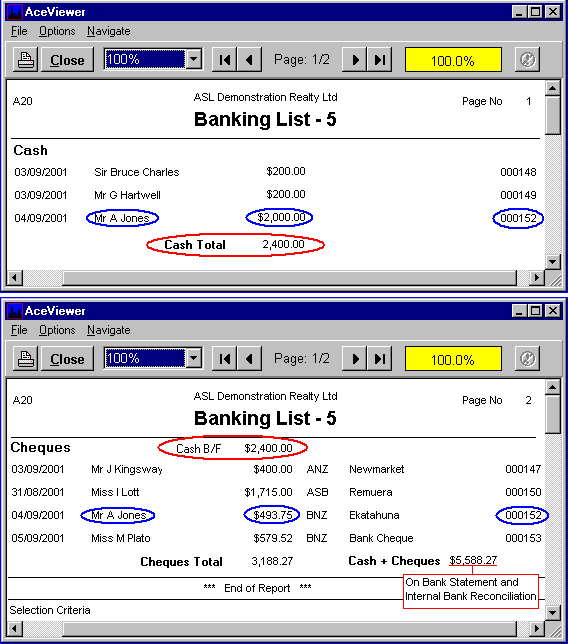

Print Banking List

Click the Printer button to print the report.

The report prints EFTPOS, cash and cheque transactions on separate pages so only the cheque page needs to be attached to the deposit slip as it includes the total cash received.

After printing you will be returned to the grid display and the report should be checked against the cash and cheque holdings. Assuming all is OK click the "Mark as Printed" button which stops the "highlighted" receipts appearing next time the report is run.

It should go without saying that if you do not accurately record the makeup of your receipts as cash and cheque, including bank and branch details, the report will not be much use.

Reprint Banking List

Use this to re-print any previous Banking List by selecting the one required from the list box where the list number and range of transaction dates are displayed. Overlapping date ranges are legitimate, as far as the system goes anyway.

If you need to Cancel a Banking List for some reason reprint it first for reference.

Cancel Banking List

If you need to change a Banking List which has been "Marked as Printed" this function "unmarks" previous Banking Lists allowing you to make changes or drop or include other transactions before running the Banking List again.

You can not cancel a Banking List which has been presented without first running the Cancel Bank Reconciliation (as many times as necessary), to gain access those Banking Lists which have been presented. You will need to repeat the cancelled reconciliations again and it's a good idea to reprint any Banking List before cancelling it, unless you have current file copies, so you can get the banking correct for any reconciliations that will need to be repeated.