Fees and GST Transactions

First.....Prev.....Next.....Last

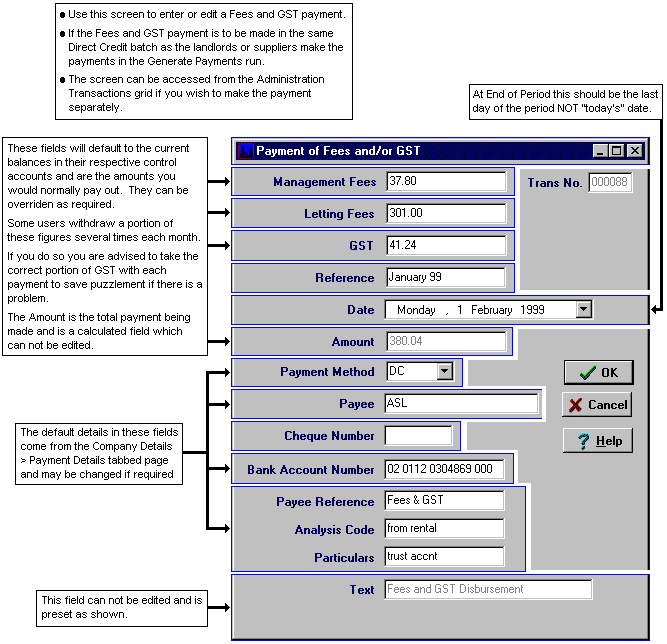

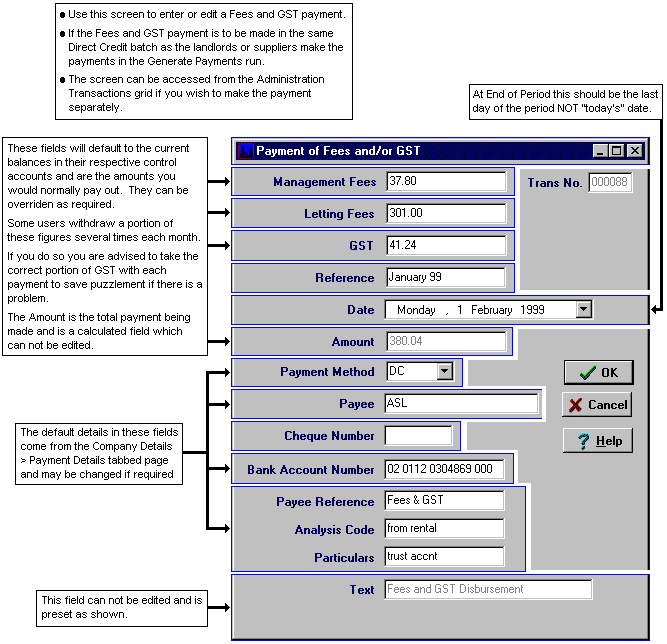

Location... Administration menu > Fees and GST Transactions > Payment button

This is the best screen in the whole system. It's the one used to pay yourself !!

Fees and GST payments can be created directly into a Generate Payments batch by ticking "Generate Fees and GST" or created manually from the Administration menu > Fees and GST Transactions > Payment button. In the latter case the payment can be "drawn into" a batch by ticking "Include Manual Payments" in Generate Payments run.

If the Fees and GST Payment screen appears during the Generate Payments process and you do not wish to create the payment, or the values are all zeros press [Cancel]. You will not be permitted to create a Payment which has no entries in Management Fees, Letting Fees and GST but the entries may add to a value of zero.

At the end of a period some users leave a "float" in the Management Fees account to cover bounced cheques and A/Ps.

Discussion

As each monetary transaction enters the system a portion of most of them is been stripped off and accumulated in special accounts for you (real good). These accounts are the Management Fee and Letting Fee accounts. Additionally, you have been acting as an unpaid tax collector, (not so good), for the GST charged on your fees which is accumulating in its own account. This needs to be passed on to the Inland Revenue Department.

Usually the fees and GST are transferred to the business's trading account and disbursed from there, but you may disburse the fees and the pay the GST directly from the trust bank account if you wish. There are no limitations on when, how often, or the value of the fees or GST you extract from the trust account. Some offices disburse once a month and coincide it with the end of period processing. Others remove all or part several times a month. Do what suits you.

Because the management fees letting fees and GST are shown as three separate figures you may just dip into one pot if you wish. However, when you do any transfer make sure you have the breakdown of the accounts it came from and the value so you can post it to the right accounts in your trading account. This applies particularly if you are taking it out in several bites. Print the Remittance Advice for your files which has the breakdown. It is preferable to always take the correct GST out when any fees are withdrawn.

Related Topics

Administration Menu Fees and GST Transactions

GST - Goods and Services Tax